International Fuel Tax Agreement (IFTA)

The International Fuel Tax Agreement (IFTA) is a tax collection agreement between the 48 contiguous states of the United States and the 10 provinces of Canada. It is designed to reduce the administrative burden of reporting motor fuel taxes in multiple jurisdictions.

- Did you know Texas Comptroller – IFTA audits are the MOST aggressive of all audits conducted by the Texas Comptroller’s Office?

- 75% of all IFTA audits result in Additional Tax Due. Click here to view the last 24 months of IFTA tax-due audits.

- The tax due (depending on the number of trucks) can run from $5,000 to $5 MILLION dollars (no kidding).Texas Tax Group has lowered IFTA audits by several thousand to several million dollars.

- Consider hiring TTG to represent you with your IFTA audit. DO NOT WAIT! Mr. Hassan Ali is one of TTG’s most experienced IFTA consultants (link here).

Texas Tax Group can often help if hired before the audit starts by reviewing your records and determining if your logs are complete or incomplete. Then combined with Mr. Hasssan Ali’s extensive experience with this audit type, can provide solutions to resolve the typical errors that lead to large tax due assessments from the Texas Comptroller of Public Accounts.

Follow this link to view prior IFTA audit defense clients of TTG

IFTA audits cover 4 years, that is a lot of records to maintain! Incomplete IFTA records can result in audit assessments of up to $20,000 per truck in TAXES, penalties, and interest.

Record keeping Requirements

You must maintain records to support the information reported on your quarterly tax reports.

1. Mileage Records

To satisfy IFTA requirements, the mileage records you keep on each qualified motor vehicle must include specific information.

Distance records produced by a means other than a vehicle-tracking system that substantially documents the fleet’s operations and includes:

- beginning and ending trip dates

- trip origin and destination

- routes of travel

- beginning and ending reading from the odometer, hubodometer, engine control module (ECM), or any other similar device for the trip

- the total distance of a trip

- distance traveled in each jurisdiction; and vehicle identification number (VIN) or vehicle unit number. Distance records produced wholly or partly by a vehicle tracking system should include the vehicle’s original GPS or other system reading

- date and time of each GPS or other system reading, at intervals sufficient to validate the total distance traveled in each jurisdiction

- location of each GPS or other system reading

- beginning and ending reading from the odometer, hubodometer, engine control module (ECM), or any other similar device for the trip

- distance between each GPS or other system reading

- routes of travel

- total distance traveled by the vehicle

- distance traveled in each jurisdiction; and vehicle identification number (VIN) or vehicle unit number.

A licensee’s reporting of distance may deviate slightly from a calendar quarter basis provided that:

- the beginning and end dates of the licensee’s reported distance reflect a consistent cut-off procedure

- the deviations do not materially affect the reporting of the licensee’s operations

- the deviations do not materially delay the payment of taxes due

- the cut-off dates for both distance and fuel are the same and the base jurisdiction can reconcile the reported distance for the period through the audit.

2. Fuel Records

You must maintain complete records of all retail motor fuel purchases, with separate totals for each fuel type.

Fuel types include diesel, gasoline, ethanol, propane (LPG), compressed natural gas (CNG), liquefied natural gas (LNG), A-55, E-85, M-85, gasohol, methanol, and biodiesel. The fuel records must contain the following information:

- date of purchase;

- name and address of the seller (a vendor code, properly identified, is acceptable for this purpose)

- number of gallons or liters purchased

- type of fuel purchased, or the total price of the fuel purchased

- price per gallon or liter

- evidence of tax paid to a jurisdiction

- unit number of the vehicle into which the fuel was placed; and the name of the purchaser of the fuel (where the qualified motor vehicle being fueled is subject to a lease, the name of either the lessor or lessee is acceptable for this purpose, provided a legal connection can be made between the purchaser named and the licensee).

Acceptable fuel receipts include invoices and credit card receipts. A credit card receipt must document the delivery of fuel into a specific qualified motor vehicle. We will not accept receipts that contain alterations or erasures.

3. Bulk Fuel Storage

If you have a bulk fuel storage facility, you can obtain credit for tax paid on fuel withdrawn from that facility if you maintain the following records:

- location of the bulk storage facility from which withdrawals are made

- quarterly inventory reconciliations for each storage tank

- the capacity of each storage tank

- date of withdrawal

- number of gallons or liters withdrawn from each storage tank at each location

- fuel type

- unit number of the vehicle into which the fuel was placed

- purchase and inventory records to substantiate that tax was paid on all bulk fuel purchases to the member jurisdiction where the storage is located; and withdrawals for purposes other than use in IFTA-qualified vehicles

4. Record Retention

You must maintain records to prove that the information reported on your quarterly tax reports is accurate. You must keep these records for four years from the due date of the report or the date the report is filed, whichever is later. You can keep your records on paper or on an acceptable computerized or condensed storage system.

It is your responsibility to maintain records of all interstate operations by qualified motor vehicles in your fleet. Noncompliance with any recordkeeping requirement is cause for revocation or suspension of your license.

5. Why is this important?

Click below to view actual Texas Comptroller Administrative IFTA Hearings for ‘disallowed IFTA records / estimated tax assessments.

- It should be noted that businesses LOSE 95% of the Hearing Requests because the judges rule against them.

- If you get an over-estimated IFTA tax audit bill then you will almost certainly lose your hearing request. Then, if you don’t pay the inflated tax bill the Comptroller will CANCEL your IFTA permit.

So don’t wait, call Texas Tax Group at 1-855-892-8348 to speak with an IFTA expert now!

Texas Comptroller Administrative Hearing #1

Texas Comptroller Administrative Hearing #2

Texas Comptroller Administrative Hearing #3

Texas Comptroller Administrative Hearing #4

Why Texas Tax Group

- TTG is comprised of a team of 20+ former Texas Comptroller State Tax Auditors, Supervisors and Tax Policy Experts with over 400 combined years of work experience with the Texas Comptroller of Public Accounts

- TTG has represented over 2,000 clients in areas of sales tax audit defense and research

- TTG’s consultants performed over 5,000 tax audits while employed as auditors by the Texas Comptroller’s Office

- TTG’s Policy Experts wrote over 5,000 private letter rulings while working for the Comptroller’s office

- TTG currently represents over 290 businesses that are under audit by the Comptroller’s office

- TTG has offices located in Houston, Dallas, San Antonio, and Austin

This Guidebook has been made available by the Texas Comptroller for truck drivers to understand and comply with IFTA Rules & Regulations.

Dino Marcaccio

Texas Comptroller State Tax Auditor: 1989-1991 & 1993-2007 (16 Years)

President and Founder of Texas Tax Group Dino Marcaccio received a BBA in Accounting in 1990 from Texas A&M University. He then spent 16 years working at the Texas Comptroller’s Office as a state tax auditor and one year with Ernst & Young in their State and Local Tax (SALT) group. Mr. Marcaccio left the Texas Comptroller’s Office on February 28, 2007, and established Texas Tax Group later that same year. Since that time Mr. Marcaccio has built TTG into a leading Texas state tax consulting firm with the borrowed motto: “No Taxation Without Representation”.

Hassan Ali

Tax Director - IFTA

Practice Areas

- IFTA (Intl Fuels Tax)

- C-stores

- Beer and Liquor Stores

- Contractors

- Motor Vehicle Seller Finance

- Penalty Officer Fraud Defense

- Hotel Occupancy Tax

- Sales & Use Tax Refund/Credit Reviews

- Manufacturers . Wholesalers / Retailers

- Mixed Beverage – Liquor Tax

Downloadable Content

Texas Tax Group IFTA Client list:

Download here

Texas Comptroller last 750 IFTA Audits:

Download here

Texas Comptroller Active IFTA Audits:

Download here

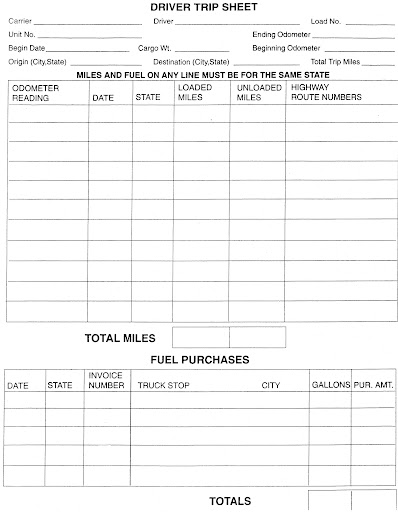

● Originating point

● Start mileage

● Name of driver

● Truck ID #

● Type of fuel used in truck

● Type of freight, destination

● Miles driven in each state

● Ending mileage

● and more

Click here to view Texas Tax Groups’ full article on the importance of complete trip sheets.